There Is a Better Way to Deploy ATMs

- Jan 20

- 2 min read

For years, Credit Unions have been forced to accept an uncomfortable reality: ATM deployments have become more expensive, more complex, and harder to justify—without delivering proportional value.

There Is a Better Way to Deploy ATMs

For years, Credit Unions have been forced to accept an uncomfortable reality: ATM deployments have become more expensive, more complex, and harder to justify—without delivering proportional value.

Large legacy ATM providers layered on features, hardware, and pricing models that no longer align with how most Credit Unions operate today. The result? Systems that feel oversized, over-engineered, and financially inefficient for the majority of locations.

It doesn’t have to be that way.

________________________________________

Why ATM Deployments Stopped Making Sense

Most Credit Unions don’t need excessive functionality at every ATM location. What they need is reliability, uptime, brand presence, and a cost structure that aligns with real usage.

Instead, many institutions have been pushed toward:

• High capital expense

• Complex service models

• Features members rarely use

• Long ROI timelines

When cost and complexity rise faster than value, it’s time to rethink the approach.

________________________________________

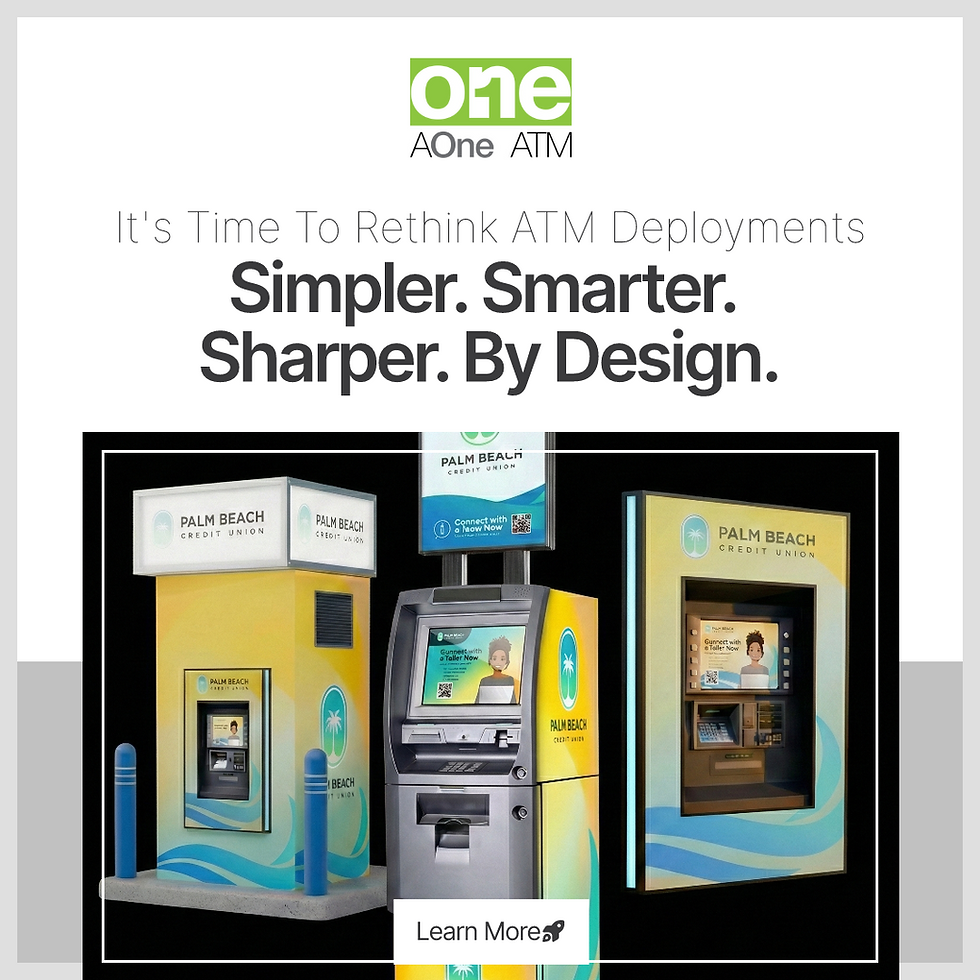

A Full Line of Credit Union ATM Options

A smarter ATM strategy starts with flexibility.

We offer a full line of Credit Union ATM options designed to fit every environment, including:

• Lobby-style ATMs

• End-of-teller-line placements

• Off-premise and remote locations

This allows Credit Unions to deploy the right solution in the right place—without forcing a one-size-fits-all model across every location.

________________________________________

Simpler. Smarter. Sharper. By Design.

Simpler

Cash dispense only—by design.

No unnecessary features. No added complexity. Just reliable, purpose-built ATMs that do exactly what most locations require: dispense cash efficiently, securely, and consistently.

Smarter

Integrations that make sense—without breaking the bank.

Modern connectivity, monitoring, and support tools that enhance performance and uptime—without forcing Credit Unions into costly, over-engineered systems. ITM-style capabilities without ITM-level expense, designed to integrate with virtually any ATM environment.

Sharper

Your brand is your most important asset.

Our ATMs deliver a clean, modern, fully branded presence that reflects the professionalism of your Credit Union. Backlit frames, accent lighting, and on-ATM marketing ensure your brand stands out—without introducing additional operational complexity.

When your brand matters, the details matter.

________________________________________

Making ATM Deployments Make Financial Sense Again

A better ATM strategy isn’t about cutting corners—it’s about making smarter decisions.

By focusing on:

• Purpose-built functionality

• Practical integrations

• Flexible deployment options

• Strong brand presentation

Credit Unions can reduce total cost of ownership, improve uptime, and deploy ATMs that finally align with both member needs and financial reality.

________________________________________

Rethink Your ATM Deployment Strategy

ATM deployments should be assets—not obligations.

If your current approach feels more expensive and complicated than it should be, it may be time to rethink how ATMs are deployed across your network.

There is a better way.

________________________________________

Comments